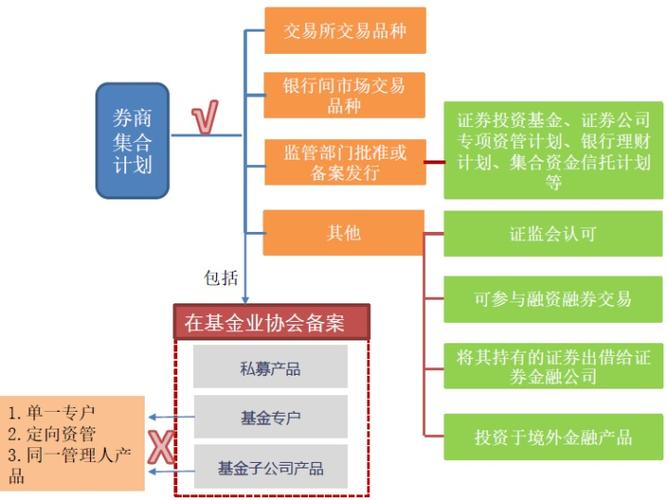

券商财富管理相比其他机构

Title: Comprehensive Management of Brokerage Collective Wealth Management Products

In the realm of finance, brokerage firms play a pivotal role in managing collective wealth through a diverse range of investment products. From stocks and bonds to more complex instruments like derivatives and structured products, the responsibility of managing these financial vehicles falls upon the shoulders of brokerage firms. However, the management of collective wealth products demands a comprehensive approach that encompasses various aspects, including risk management, regulatory compliance, portfolio diversification, and client relationship management.

1. Risk Management:

Effective risk management lies at the core of brokerage collective wealth management. Brokers must assess and mitigate various types of risks, including market risk, credit risk, liquidity risk, and operational risk. Robust risk management frameworks involve identifying potential risks, quantifying their impact, and implementing strategies to hedge or mitigate these risks. Regular stress testing and scenario analysis help in evaluating the resilience of investment portfolios under adverse market conditions.

2. Regulatory Compliance:

Brokerage firms operate in a highly regulated environment governed by stringent laws and regulations. Compliance with regulatory requirements is paramount to ensure transparency, fairness, and investor protection. Firms must adhere to regulations set forth by regulatory bodies such as the Securities and Exchange Commission (SEC) in the United States or the Financial Conduct Authority (FCA) in the United Kingdom. Compliance measures include disclosure of risks, fair pricing practices, antimoney laundering (AML) procedures, and adherence to knowyourcustomer (KYC) requirements.

3. Portfolio Diversification:

Diversification is a key strategy employed in managing collective wealth products to mitigate risks and enhance returns. Brokerage firms construct welldiversified portfolios by allocating assets across various asset classes, sectors, and geographical regions. This diversification strategy helps in reducing concentration risk and volatility, thereby enhancing the stability and performance of investment portfolios. Modern portfolio theory, along with advanced risk management techniques, guides brokers in optimizing portfolio diversification.

4. Investment Research and Analysis:

Indepth investment research and analysis form the foundation of sound investment decisions in brokerage collective wealth management. Brokerage firms employ teams of research analysts to conduct fundamental analysis, technical analysis, and quantitative analysis of potential investment opportunities. These analyses help in identifying undervalued assets, assessing market trends, and formulating investment strategies tailored to meet clients' financial objectives and risk tolerance.

5. Client Relationship Management:

Building and maintaining strong client relationships is essential for brokerage firms to succeed in collective wealth management. Firms must understand clients' investment preferences, risk appetite, and financial goals to provide personalized investment solutions. Effective communication, transparency, and responsiveness are key pillars of client relationship management. Regular client reviews and updates ensure alignment of investment strategies with evolving client needs and market dynamics.

6. Technology Integration:

The integration of technology has revolutionized brokerage collective wealth management, enabling firms to streamline operations, enhance efficiency, and deliver innovative investment solutions. Advanced trading platforms, algorithmic trading systems, and artificial intelligencepowered analytics facilitate realtime portfolio monitoring, trade execution, and risk management. Additionally, technologydriven roboadvisory platforms offer automated investment management services, catering to a broader spectrum of investors.

In conclusion, effective management of brokerage collective wealth products requires a multifaceted approach that encompasses risk management, regulatory compliance, portfolio diversification, investment research, client relationship management, and technology integration. By adopting a holistic strategy that addresses these key aspects, brokerage firms can navigate through market uncertainties, deliver superior investment outcomes, and foster longterm client relationships.

免责声明:本网站部分内容由用户上传,若侵犯您权益,请联系我们,谢谢!联系QQ:2760375052